Services we offer

For your very specific industry,

we have highly-tailored IT solutions.

For your very specific Trading investment we have,

highly-tailored Stocks and commodity broking

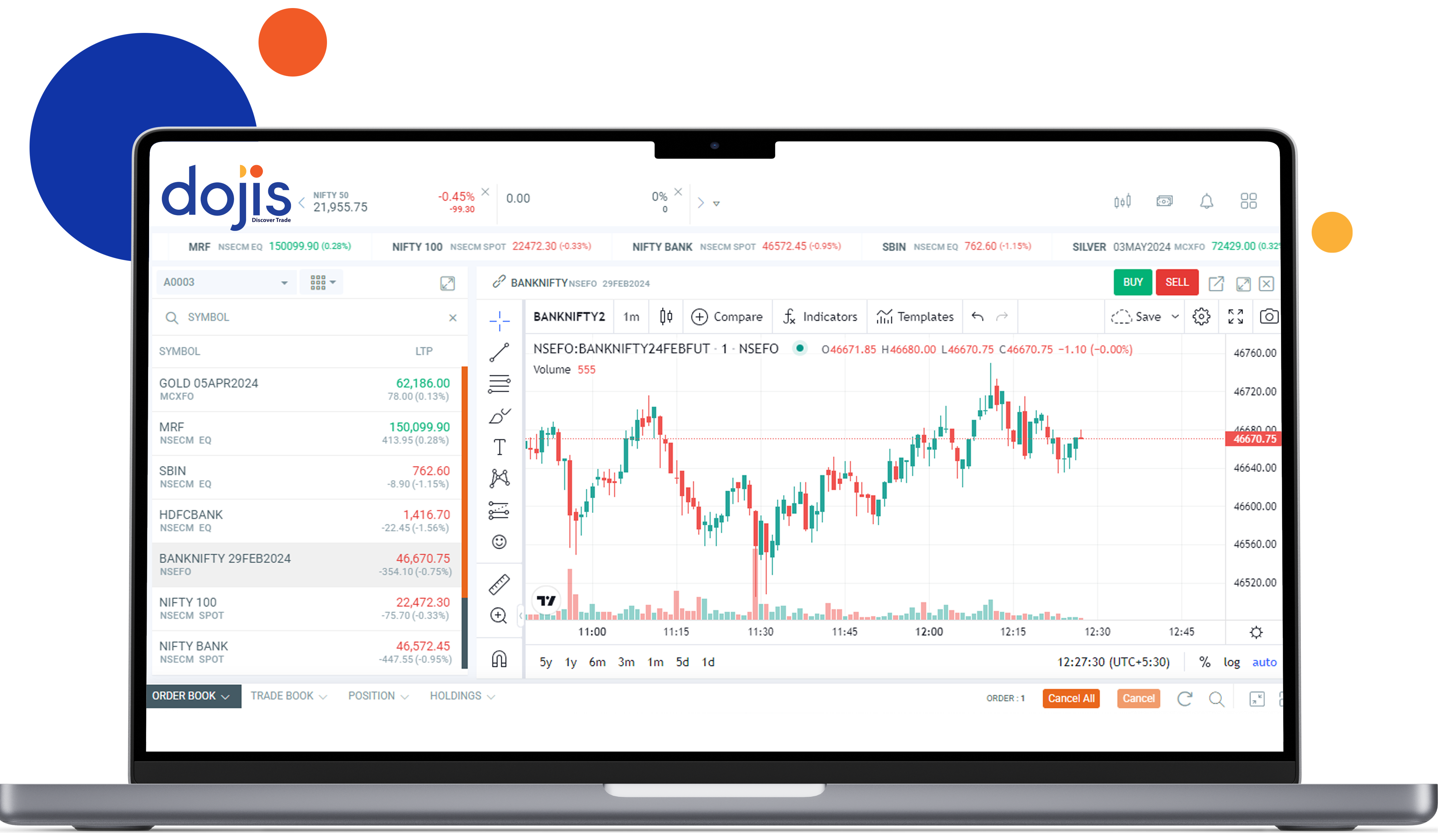

Next Generation

Trading Platform

Powerful Trading in Futures, Options Commodities made simple

- Modern usability for comfortable access

- Save every second! Execute trades directly from charts for efficient trading.

- Powerful Analysis & Execution

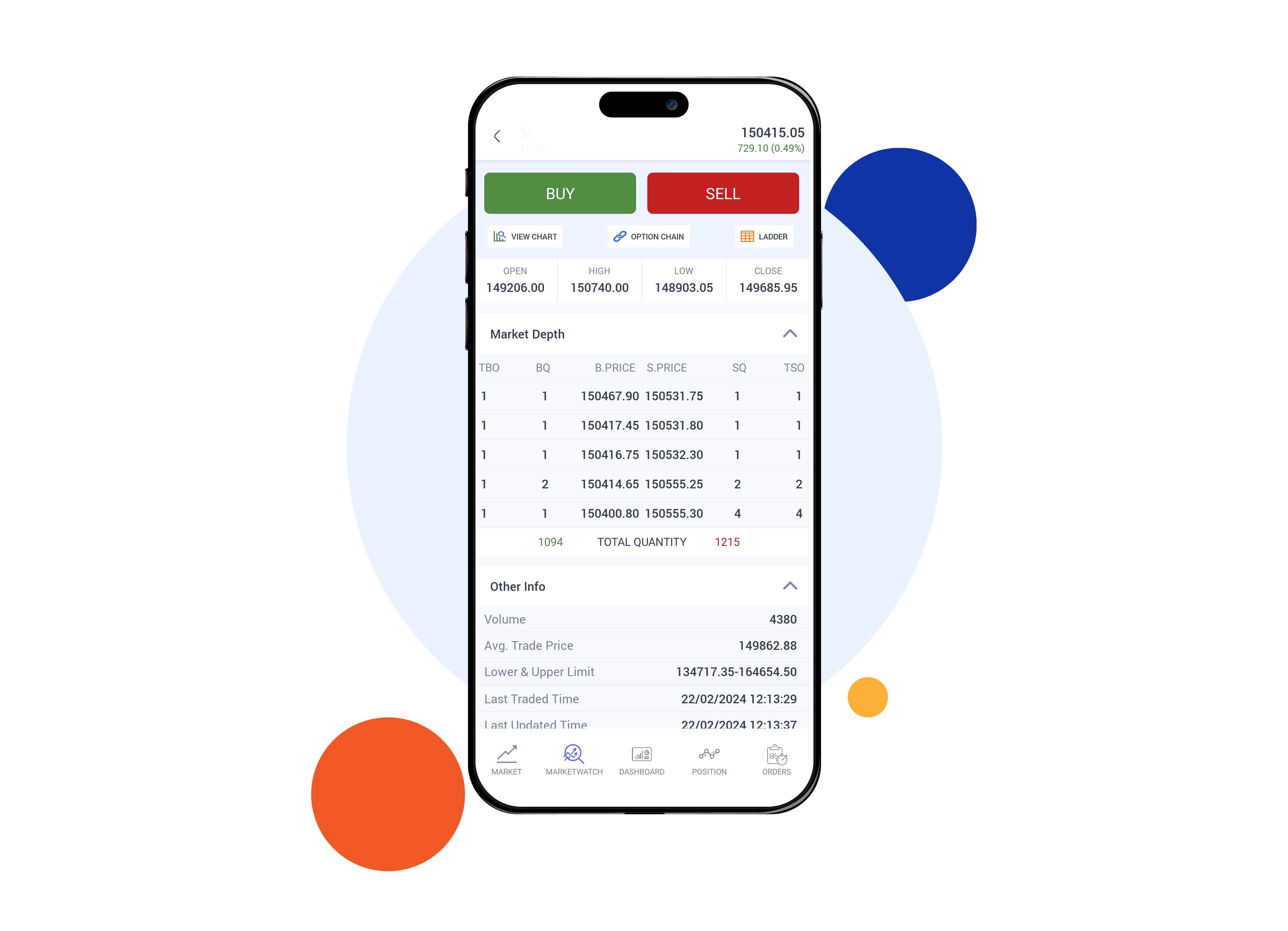

Simple and Powerful Mobile App

Effortless Trading Across Stocks, Futures, Options, Commodities With Streamlined Simplicity

- Buying, selling, analyzing – all in one place

- Intuitive shortcuts and icons

- Enhanced Trading Features

Why Choose dojis?

Brokerage

Customised broking

plans as per your

needs.

Technology

It’s made in a way that

people from all

generations can use it

easily.

Client Centric Approach

We understand you

first and pitch you later.

Legacy of 12 years

Use our 10+ years of

experience to enhance

your investments.

Open Demat Account In Just 15 Minutes!

-

Click On Open Account Below

Take the first step, add your contact information

-

Fill Basic Details

Fill in your PAN and Aadhar details

-

Upload Documents

Upload a few basic documents & E- sign

your documents with Aadhar. Start Trading In 24 Hours

Check your email for credentials &

start trading

Risk Discolosures on Derivatives

- 9 out of 10 individual traders in equity Futures and Options Segment, incurred net losses.

- On an average, loss makers registered net trading loss close to ₹ 50,000.

- Over and above the net trading losses incurred, loss makers expended an additional 28% of net trading losses as transaction costs.

- Those making net trading profits, incurred between 15% to 50% of such profits as transaction cost.